GBPUSD reversed direction gaining 400 pairs but get enough resistance at 1.3100. This week’s highlights are Prelim GDP q/q.

GBPUSD reversed direction gaining 400 pairs but get enough resistance at 1.3100. This week’s highlights are Prelim GDP q/q.

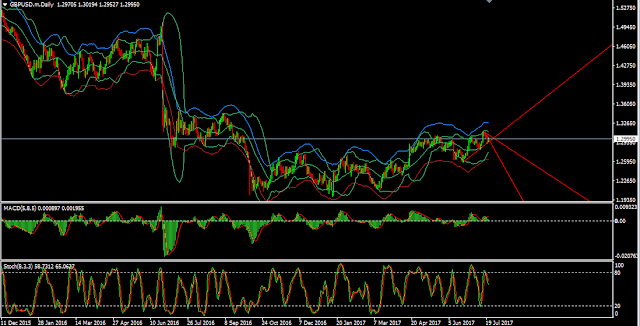

GBPUSD opened at 1.3095 and closed at 1.2995 with small correction. On its weekly chart GBPUSD recently broke its trading channel and sustaining above it indicating the bullish trend in mid term to long term basis. Nearby support level at 1.2950 supported by 100 day Moving Average. Investors can adopt the buy on dips strategy.

GBPUSD neutral trend

The British economy is showing some signs of fatigue and the Brexit cloud is making investors nervous. The Fed is on record that it will raise interest rates a third time in 2017, but the markets have their doubts, as inflation remains weak and second quarter numbers in the US have not impressed.

Overlays:

Bollinger Band: Gold has crossed the mid band of 1.2930 & now trading 1.3000

Indicator & Oscillator

MACD- MACD momentum above Signal line which is indicating bullish signal.

RSI –Relative strength Index broken 50 and sustaining above the level giving confirmation to positive trend.

Stochastic: K% Crossed D% which indicates further bull run.

Comments

Post a Comment